To get the rest of this free white paper, please click here.

Credit & Collection Practices 2011

Extracted from new research published by the Ascent Group, Inc.

The US and world economies continue to struggle in the current recession. Unemployment, foreclosures, and bankruptcies have affected people from all industries and wage levels, forcing many to choose between the bills they can and cannot pay. As a result, many public and private sector companies are seeing a rise in delinquency rates, fraud, and default. Requests for payment extensions and longer-term payment agreements are increasing as well as the number of accounts pursuing financial assistance. The economy has not only been tough on individuals, it has hit many businesses hard as well, causing a rise in commercial bankruptcies.

Additionally, increasing field collection and enforcement costs combined with hiring freezes and even downsizing are stressing existing collection workforces, forcing companies to find ways to be smarter in managing the workload while limiting risk. As a result, many companies are taking a closer look at the collections process to manage increasing workload and at the same time minimize the impact of the changing economy. Many companies are turning to credit modeling to manage risk more effectively and predict delinquencies and default earlier. Companies are also pursuing solutions that will help them to be more proactive in managing bad debt without compromising the high level of service that has become standard for many industries.

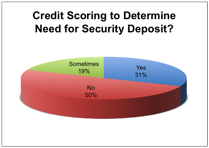

Risk management has evolved into a careful balancing act between customer satisfaction and prudent financial management. In the past, many energy, water, and telecommunications companies routinely collected security deposits from all customers—risk mitigation at the expense of customer satisfaction. Credit scoring and modeling have helped companies balance risk and satisfaction, objectively identifying the accounts that require a deposit and those that do not. It’s a win-win for companies and customers.

Risk modeling can be used throughout the customer’s relationship with the company. Risk analysis can be applied to active account collections, determining the need to send late payment reminders or discontinue service, or even to prioritize callers in queue. It can also be applied to inactive accounts, to determine the most appropriate follow-up based on account payment behaviors, thereby increasing recoveries.

By minimizing credit related risk up-front and throughout the account life cycle, managers can reduce operating costs and significantly improve profitability. They can also actively look to expand their service offerings to customers and increase customer satisfaction, secure in the knowledge that doing so will not cost the company and shareholders millions in increased uncollectible funds.

Benchmarking Study Findings & Observations

With this in mind, the Ascent Group kicked-off its credit and collection benchmarking research during the fourth quarter of 2010. This is the third annual study of collection practices conducted by the Ascent Group. The goal of the research is to uncover the most effective techniques and strategies for improving collection performance and reducing uncollectible debt.

Our research explores how companies are balancing the cost of collection to reduce uncollectible debt and improve the bottom line. Topics investigated included both collection treatment as well as the credit policies that have been established to support collection efforts. We also examined the technologies that have retooled credit and collection processes for maximum effectiveness and efficiency. Thirty companies participated in the research. A list of participants is included at the end of this report.

Budget cuts and hiring freezes are forcing most credit and collections organizations to work smarter. Fortunately, there are technology solutions and best practices to help managers evaluate and differentiate customers by risk.

Issue Credit Wisely

Only one-third of participants routinely use an external credit bureau to score consumers applying for service—to determine the need for a security deposit. Credit scoring can help companies balance risk and customer satisfaction—appropriately identifying the accounts that require a deposit and those that do not. Take advantage of this technology, it’s a win-win situation for companies and customers.

In addition to traditional Beacon scoring, Equifax offers credit scoring based on utility payment behavior. This energy score is a better predictor of energy customer payment behavior, increasing the likelihood that deposits will be secured for the appropriate accounts.

In addition to scoring, many companies are actively participating in industry credit exchanges, such as the National Consumer Telecom & Utilities Exchange. The National Consumer Telecom & Utilities Exchange is a collection of utilities and telecommunications companies that have formed a common “database” of bad debts and new customer sign-ups. Participants are notified when information is available about a new applicant or uncollectible account. Investigate joining an industry credit exchange to further fine-tune your credit issuance process.

Continue to evaluate account credit over the life of the account to make sure you have adequate deposit coverage—increase security deposits as accounts becomes more risky and requires more collection treatment.

Consistency is Key

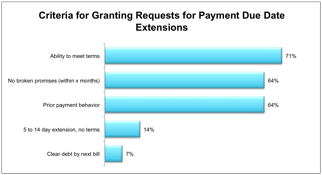

Consistency is key when it comes to collections. Customers will “shop around” for the best terms and arrangements. It is essential to clearly define credit terms and provide tools to help representatives identify and determine the appropriate credit-risk category for callers. Clearly defined and followed credit guidelines will minimize the shopping.

Make sure you provide the training, techniques, and tools to help representatives offer consistent credit terms when negotiating with customers. Not only will this minimize “representative shopping” it will reduce agent stress and increase confidence.

continued…

Download the rest of this free white paper.

Purchase the research report, Credit & Collection Practices 2011.

More information about Credit & Collection Practices 2011.