To get the rest of this free white paper, please click here.

Benchmarking Meter Reading Performance

An extract from Meter Reading Profiles & Best Practices 2014, a new research report published by the Ascent Group, Inc.

Meter reading is the critical first-step in the utility revenue collection process, and for many utilities, still a very labor-intensive activity. While the use of automated meter reading technologies (AMR) and advanced metering infrastructure (AMI) is increasing, the majority of electric, natural gas, and water meters are still read manually, on a monthly basis. Any errors or delay in the meter reading process, delays billing or necessitates the delivery of an estimated bill to customers—both of which negatively impact customer satisfaction.

Utilities, now more than every, are faced with growing need for more timely access to energy usage information—to support real-time pricing initiatives, load forecasting, demand-side management, load control, competition, and customer demand. Additionally, status and usage information is needed on an event basis to improve reliability, power quality, and to identify outages. These more complex data requirements are driving the need for advanced metering infrastructures, smart metering, and system-wide automation.

The American Recovery and Reinvestment Act (ARRA) Smart Grid Investment Grant Program has spurred a growth in automating usage collection for electric utilities, but at the same time stirred up new challenges, such as, gaining approval for funding, issues with meter-related fires, as well as customer acceptance of new technologies. As of July 2014, more than 15 million AMI meters have been installed by US utilities participating in the ARRA funding.

In July 2013, IEE, an Institute of The Edison Foundation, reported 45 million smart meters installed in U.S. households (40 percent). According to other recent research by Navigant Consulting, the U.S. smart meter market has leveled off, with the depletion of federal funding. However, activity is increasing in Western Europe, with projects that will deploy 93 million meters by the end of 2020. Eastern Europe utilities are also ramping up for smart meter deployments.

The stimulus has reinvigorated research and development—innovative AMI and smart grid technologies are breathing new life into meter reading automation, along with presenting options to engage the consumer. We are also seeing more automation— among our panel, most (72 percent) have implemented AMR/AMI technology to some degree, with a panel average of 73 percent automated meters. AMR/AMI also remains the top plan for the future for our participants.

Clearly the utility meter reading organization continues to evolve with the introduction of automation. The diversity of metering and AMR equipment, complexity of accounts and billing, the challenges of service territory, and the needs of different customer classes dictate different solutions for different companies.

Regardless of the implementation rate, the transition from manual to automated meter reading is challenging from a technology, customer, and employee perspective. Routes must be consolidated and optimized, employee roles and responsibilities change with changing priorities, performance measurement metrics shift to accommodate the mix of automation and manual effort, processes and systems change, customer communications must be timely and informative… it’s a challenging time for any organization. Even after automation, metering devices must be visited periodically to ensure proper operation and to protect assets, even more so now after several AMI meter-related fires at utilities have increased public attention on the safety of AMI meters. While automated meters may solve access problems, recent safety developments may result in more rigorous meter inspection programs and revenue protection initiatives.

In this transition to automation and the quest for reduced operating expenses, most utilities are focusing on three basic approaches to meter reading improvement:

- Automated meter reading–large-scale implementation as well as strategies to pinpoint “high read cost” meters, unsafe meter locations, and high-turnover premises. Some companies have automated “key accounts” and commercial accounts to accommodate real-time pricing and/or prepare for the competitive market.

- Contract meter reading to reduce overhead, tackle seasonal peaks, and as a strategy to transition to automated meter reading.

- Reducing costs of manual reads through contract negotiations, rerouting, more sophisticated hand-held equipment and meters, productivity improvement, and lowering overhead; many have maxed out these options; Some have reduced costs to a point that makes it difficult to justify AMR, for residential accounts.

The promise of automation—AMR implementation remains the top plan for the future, partial or complete, for our utility panel. Other automation plans indicate a continuing interest in route optimization software and handheld technology upgrades.

To better understand how utilities are dealing with the challenges facing the meter reading function and its day-to-day operations, the Ascent Group conducted its ninth annual benchmarking project to evaluate Meter Reading performance and practices. Twenty-four utilities participated in the 2014 benchmarking research.

Benchmark Study of Meter Reading Practices

The main objective of the study was to evaluate the various tactics and strategies used today to read customer meters in order to identify best practices or opportunities for improvement. Secondary objectives included understanding:

- The practices linked to “best-in-class” performance;

- The range of performance by company and by industry segment;

- How utilities are using technology to reduce costs and improve customer satisfaction;

- Other effective process improvement or cost-reduction techniques;

- How utilities measure individual, team, and center-level performance and encourage high productivity and performance;

- The role of meter reading training and its impact on performance.

- How companies are resolving the hard issues, such as inaccessible meters.

- To know what is possible.

Participants were asked to share management tactics and strategies, as well as identify any improvement in performance. The study also asked utilities to include considerations, successes, and plans moving forward.

Study participants range in size from 14,600 meters to be read to as many as 12.4 million. Seventy percent of participants read less than the participant average of 644,000 meters per month. The majority of study participants were from the United States, however we did have three utilities from Canada, and one from Australia, United Arab Emirates, Tanzania, Kenya, and India. Bargaining units represent 54 percent of participants’ meter readers.

Benchmarking Meter Reading Performance

When evaluating performance of any organization, it is best to look at performance from three perspectives: Productivity, Cost, and Service. We asked companies to report meter reading operational data so we could calculate several performance benchmarks. The following benchmark metrics were collected and calculated, based on participant feedback:

- Unit cost (cost per meter read –Operational & Maintenance costs only – direct labor, contractor costs, overtime, and non-labor O&M; no capital costs or overhead)

- Meter Reading Accuracy (for a representative month)

- Percent Meters Read (for a representative month)

- Meter Reading Productivity (meters read per FTE (per month))

Based on these benchmark metrics, we identified the “best performers” for each industry-segment (electric, natural gas, combination utility, and water/wastewater). Best performers were identified as those companies that deliver low cost meter reading, high productivity, and high service (low errors, low skips). We then calculated a “best performer” average for these high performing companies.

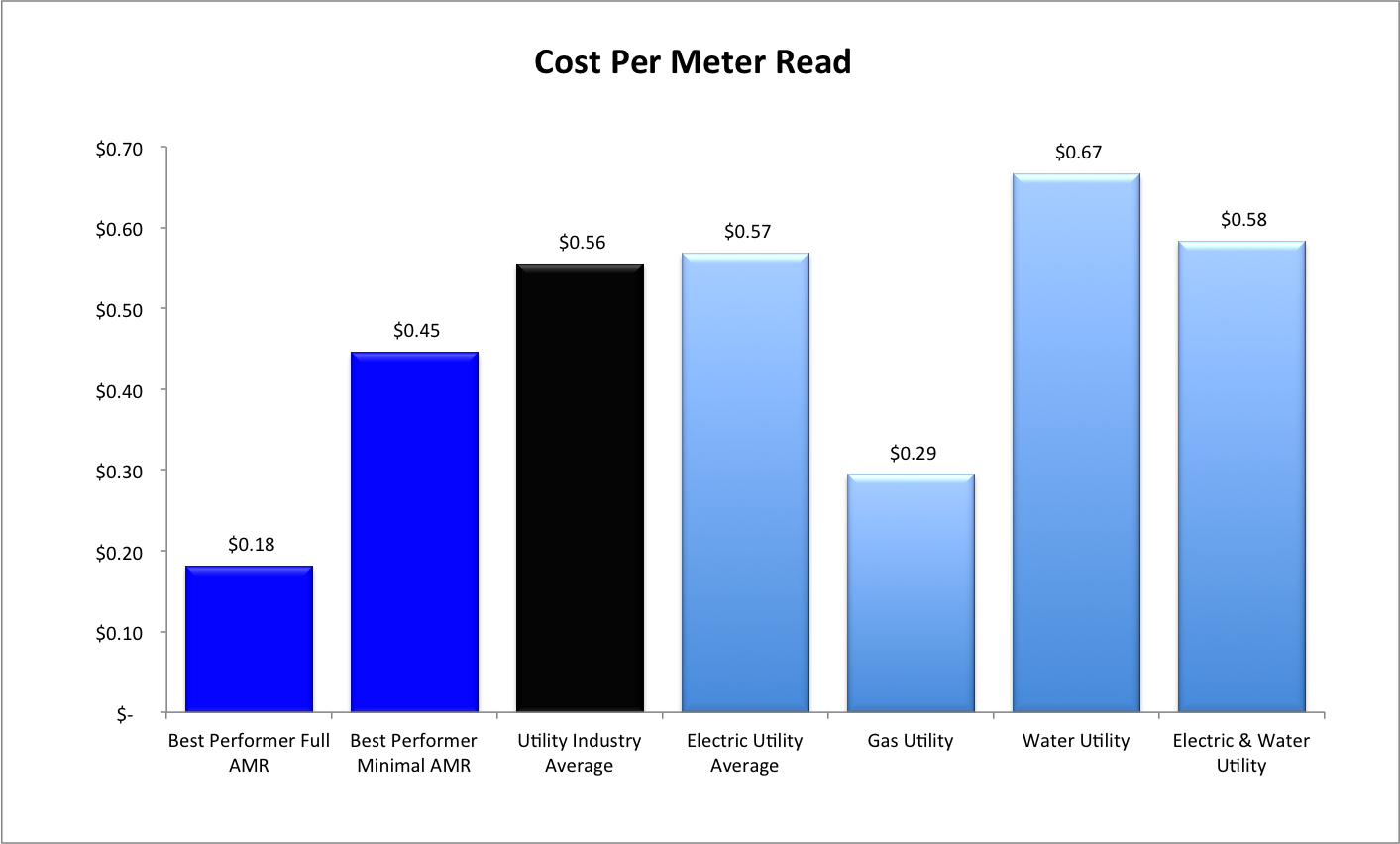

The “best performer” averages are depicted on the chart appearing on the following page. This is one of seven benchmarking metrics analyzed in this report. We also calculated an industry-segment average for each of the benchmark metrics, to demonstrate the performance of industry, by segment.

To gain an understanding of how your company’s meter reading performance compares and to identify opportunities for improvement, you can compare your performance against the “best performer” average and the industry and industry-segment averages.

“Cost per Meter Read” was calculated based on cost data submitted by each participant. Unit cost in this analysis represents Operational & Maintenance costs only—direct labor, contractor costs, overtime, and non-labor O&M—no capital costs or overhead.

Because AMR heavily influences labor and other O&M costs, we included two Best Performer averages for comparison—best performers with “Full AMR” and “Minimal AMR”. In this analysis, “Full AMR” best performers averaged 96 percent AMR meters and “Minimal AMR” best performers averaged less than 1 percent AMR meters.

Similar analysis was conducted on the other six meter reading benchmark metrics captured by this research. The full results of our meter reading benchmarking analysis is published in Meter Reading Profiles & Best Practices 2014. More information can be found on our website at www.ascentgroup.com

Characteristics of a Best Performer

1. Use AMR Strategically -- to address inaccessible meters, unsafe meter locations, high turnover premises, and other high-read cost meters.

2. Continually Optimize Routes – to maximize productivity and reduce costs.

3. Implement Clear and Concise Measures of Meter Reader Performance – give employees a clear idea of job expectations and performance.

4. Encourage High Performance through Incentives and Rewards – encourage the right behavior through incentive programs and/or informal or formal reward programs.

5. Train and Equip Meter Readers – provide employees with the tools, safety equipment, clothing, and training to do the job right the first time. Best performing utilities use AMR strategically to address inaccessible meters, unsafe meter locations, high turnover premises, and other high-read cost meters.

continued…

Download the rest of this free white paper.

Purchase the research report, Meter Reading Profiles & Best Practices 2014.

More information about Meter Reading Profiles & Best Practices 2014.